Nigeria’s headline inflation rate slowed to 20.12 per cent in August, the fifth consecutive monthly decline and the lowest reading in over two years, official data indicate.

The National Bureau of Statistics released the number in early September, reporting a sustained downtrend from earlier-year higher rates.

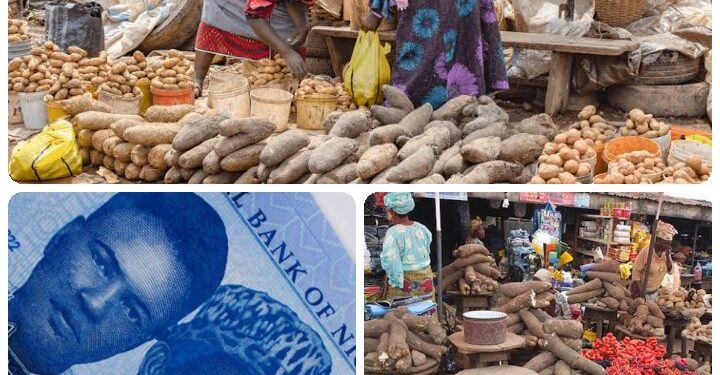

The fall has been welcomed by policymakers and market strategists who credit improved availability of basics and a calmer exchange-rate pass-through as the main drivers. But households throughout the country continue to grumble that basics remain costly, marking a disconnect between headline numbers and reality on the ground.

What the numbers show

The NBS statistics indicate that although the year-on-year pace eased to just over 20 per cent in August, food prices, which account for the largest portion of budget expenditure, remain high. The month-to-month figures also suggest the pace of price rises has slowed compared to mid-half peaks caused by logistics hitches and festival demand. Independent tracker and analysts stationed at trading sites validate the downtrend evident in official statistics.

Reasons for the slowdown

Analysts attribute the slowdown to a number of domestic drivers. First, harvest releases and restoration of supply chains after seasonally induced disruptions have increased the supply of the major staples in the urban areas. Second, the muted pass-through from previous naira weakness means import cost pressures are less lagged than before. Third, selective public interventions to stabilize prices in certain states combined with better logistics for the distribution of foodstuffs to consumption centers have helped to mitigate sharp shortages that previously pushed up prices.

What people are saying

Conversations with Lagos, Abuja and Kano residents indicate that although the rate at which prices increased has slowed down, purchasing power has yet to reach pre-2024 levels. A Lagos government official described normal shopping as “still a strain,” noting that certain items like rice and tomatoes are readily available, but other essentials still command inflated prices. Market women in the main markets reported better supplies but asserted that transport and storage costs still drive end prices.

Policy implications and the way forward

Experts and international organizations recommend keeping the focus on augmenting domestic food production, keeping things simple and hassle-free in logistics, and having a stable exchange-rate policy so that disinflation continues on the right track. The IMF’s recent analyses noted that the underlying structural problems of production and supply chains need to be addressed so that lower inflation is sustained. Without complementarities in agriculture and transportation, any disinflation could be disrupted by shocks in supply or world prices.

Targeted support and risk management

Among the perennial themes of policy discourse is the need for targeted support to the bottom three million. Even as headline inflation turns towards moderation, real incomes remain under pressure, and social protection mechanisms are thinly covered. Government programs that enable access to staple food and rationalize logistics bottlenecks can bring relief to poor households. This would be matched with contingency plans for adverse weather or international commodity price movements that will be required to stop price momentum from turning around.

Business response

Companies that source their inputs locally are optimistically protective over projected costs within the next several months, and some manufacturers say they will reassess plans to set prices once they see sustained stability. Yet companies that remain heavily reliant on imports still anticipate surprises from exchange rates and shipping holdups. Trade groups called for clearer policy signals and investment in domestic production capacity to wean the economy away from imports that expose companies to external shocks.

Conclusion: guarded optimism

Recent string of lower inflation figures gives policymakers a chance to lock in gains, but delivering headline improvement into broader relief for families will require concerted action across agriculture, logistics and support income. For the average family, easing month-by-month is to be embraced, but genuine relief at the market stall will depend on whether the gains from supply and policy measures hold up to the pressure from season and the world outside.